Case Study: Philadelphia SFH

This is a case study of a property I bought and rehabbed in the latter half of 2019 in Philadelphia, PA. Feel free to post any questions you may have about it!

The Numbers

Purchase price: 24k

Renovation: 89k

Estimated ARV at time of purchase: 160k

Actual ARV after rehab: 203k

Monthly income: $1500/mo + utilities

How Did I Get This Deal?

This deal was brought to me by a wholesaler that my general contractor (who I have done other deals with) knew. He was bringing us deals first because he knew we were buyers that could move quickly and were serious. I purchased this deal with hard money/private money (Finance of America: happy to make an introduction there if anyone is interested) to implement the rehab, with the intention of cash out refinancing the property once we completed our construction plan (30 year fixed). The hard money loan terms were 1 year, 9% simple interest, with interest-only payments.

Due Diligence and Underwriting

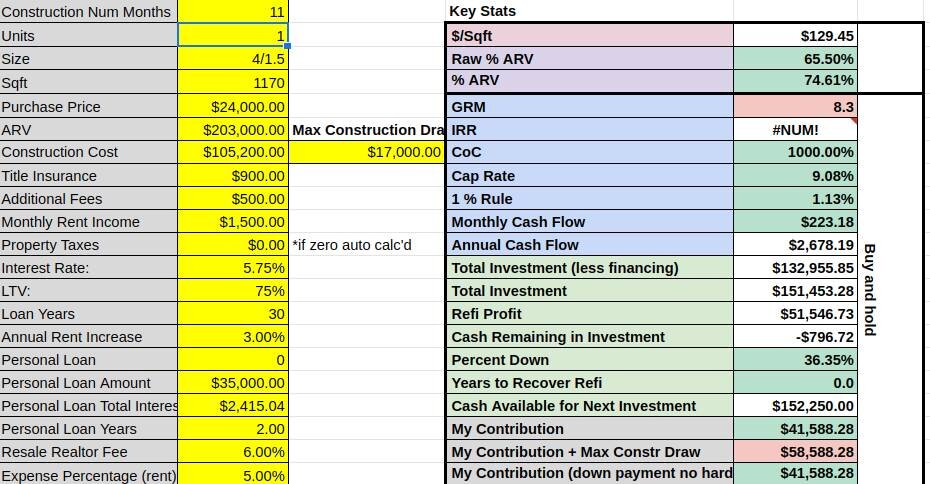

Using my custom built calculator that is tailored to the Philadelphia market (ask me if you are in that market and would like a copy!) this is what underwriting for this property looked like before the purchase:

As for due diligence, I had my contractor take a look at the property and it was pretty easy to see that this was going to be full gut. This minimized risk because we were already planning on redoing all of the major items: electric, hvac, plumbing, and roof.

I also checked with the city for taxes, liens, and zoning. Always make sure to check these things! I’ve seen some people burned by zoning.

Here are some photos of what it looked like at purchase. Seems livable, right? :)

What Went Unexpected?

First, we had an unexpected sewage line issue that was only found at the very end when we went to hook up to the main street line. The pipe was showing signs of breakage and needed to be replaced. This resulted in about an extra 11k in costs overall! Luckily we bought the property with lots of margin or this could have been even more painful than it was. This ended up delaying the project by a month as well, and that led to us not being refinanced out in time for the next unexpected event, COVID!

For those of you who were not looking for commercial loans during March - June 2020, IT WAS A NIGHTMARE. The secondary market for commercial loans completely dried up when the country went into lockdown, and many consistent lenders closed their doors. Anyone who didn’t had 30 year fixed rates in the 8-10% range! I was a week away from closing on my refinance (had appraisal done, terms drawn up, and title completed), and the lender pulled out at the last minute. This was painful, but luckily I was able to place a qualified tenant in the property at the market price I was looking for (was still cash flowing even with the higher rate bridge loan).

I always get my bridge loans on 1 year terms in case something unexpected like this happens even though most of my projects take around 2-6 months to complete. That extra buffer might be a little more expensive, but to me it is worth it to buy more time in extraordinary circumstances (like a global pandemic). It allowed me to weather the lending storm until rates came back down late in the summer. Even in the worse case if I came up to the 1 year mark, I could pretty cheaply purchase a few month extension or refinance on another bridge loan, so I never felt like I was out of options.

Final Results

We were finally able to do a cash out refinance in August (11 months after purchase, 6 months after we finished the full rehab), greatly reducing the monthly costs and getting the bridge loan off the table.

Here were the final numbers after we finally refinanced it with the 11 month holding period with the bridge loan through the COVID lending lock up. Ended up doing a full BRRRR on this one while still making a conservative $225/mo (in reality it is closer to $400/mo, but I bake in reserves and unexpected expenses in the calculations below).

Here are photos of what it looked like after completion. Very satisfying, right?!

Happy investing!