Deal Analysis: Almost Made A Big a Mistake on This Deal!

Updated: Feb 2, 2020

Quick recap of an interesting deal that I almost mistakenly bought.

Location: Drexel Hill, PA (suburb of Philadelphia)

Property Type: Single Family Home, attached

A few months back, I did a marketing campaign directed towards vacant homes with owners outside of the state. One of the leads from this campaign had a few homes, but it didn't work out to buy any of them from her at the time.

As is recommended (and I can definitely attest to this!), I kept following up with this lead every few months. Early this year, she happened to have another property available for purchase that I wanted to either wholesale or fix and flip.

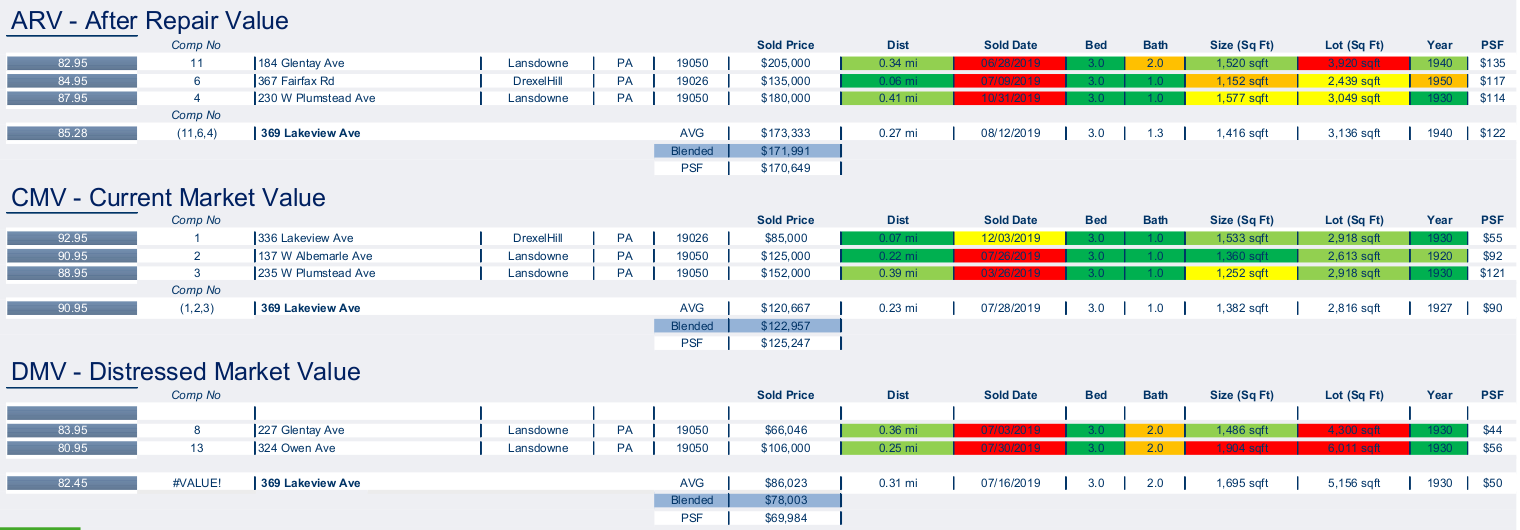

As always, the first task at hand was to run comps. Here was the breakdown (using REI Autocomp, which I recommend using):

ARV: $171-$185k

Next, the asking price.

The seller said it definitely needed some work, and that one tenant has been there for many years now (they just moved out, which is why she wanted to sell). I used a TaskRabbit courier to get photos inside of the property (~$30 and was done the day I ordered it, would recommend for remote investors!). They can be viewed here.

There was obviously some cosmetic work to be done there, but not a crazy amount. I checked with my contractor and he figured on the high end that it could be done for around $40-45k.

With that info, I checked in with my mentor and he recommended the following:

185K x 70% - 60K renovation - 15k wholesale/holding costs ~= $53,500 offer

I offered this to the seller, but she said she had several other offers in the high 70k's and so would accept that (side note, if I would have followed up more often, I would have likely gotten to this property before the other interested buyers got into a bidding war). I took a look at the numbers, and began to like it more and more, even at the higher price point.

Here was my conservative analysis (i.e. high end on construction, low end on ARV, median rent for the area, and 6 month to complete any work on the property):

Things I liked about this deal:

Conservative numbers still resulted in $20k profit, with an upside closer to $40k profit

Construction would only likely take around 3 months

It worked out well as a rental, even with flip-level renovations (this was a key factor, since it mitigated risk substantially, especially for my first flip since there was a solid fallback plan)

Location was great

The seller had several offers on the table, with the highest one being $80k cash, but with a 3-4 week closing timeline. Despite being late to the table, I was able to get her to take our offer of $80k by telling her that we would close within a week (which we would), and by telling her that the longer term cash buyers were likely wholesaling the property, which wouldn't even guarantee a close if they don't find a buyer. She also trusted me more than the other sellers since we had been in touch a few times over the past 6 months.

At this point I was pretty excited to close on this one. On the day we would sign the contract, we had a partner go out to the property to take a look at it and to get more photos of the place. This is where we caught a key oversite. There was a shared driveway with the house next door.

What I didn't see in any of my pictures was the neighbor situation:

It seems obvious, but when coordinating remote, I did not get any up to date pictures of the rest of the neighborhood and neighbors. What we discovered was that the immediate neighbor (who shared a driveway with the subject property) had all kinds of stuff strewn about the lawn. These were not just temporary items or a one day garage sale. This looked like it would be difficult when it came to selling the house, and I completely missed this*. Thankfully, my partner wanted to double check and ended up seeing this, or we could have gotten into a sale that would have been way more difficult than it needed to!

*In all fairness, we likely could have gone forward with that deal and done well, but I appreciate working with partners/mentors who like to err to the conservative side of things. Better safe than sorry!

Takeaways

Building rapport with the seller can go a long way, even to the point of them taking your offer even if it is lower/not the best offer on paper.

The ability to close fast is always a huge plus.

It sounds obvious, but if you are remote, make sure you get photos of the neighbors and neighborhood in addition to the inside and outside of the house!

It is a huge risk mitigation to have a fix-and-flip also work as a rental.

It is imperative to follow up on leads that did not pan out before. You never know if/when circumstances change, so keep on following up.

Partner with someone who is more experienced and will catch your mistakes!

If this has provided value to you, please share with others and subscribe to the blog or give us love on any of our social media platforms: